A (Partial) Year In Review

The end of the financial year looms in Australia, and the first half of the 2025 calendar year has been nothing short of dramatic: Liberation Day, two interest rate cuts, ongoing geopolitical unrest, and significant volatility and dispersion across listed markets.

Amidst the uncertainty, two key themes have emerged across our observed markets:

1. Surging Capital Flows into Private Credit

We have seen a wave of capital flow into private credit, as illustrated by data sourced from the RBA/Preqin (www.rba.gov.au, www.preqin.com) which shows that aggregate investment into private credit by Australian investors doubled between 2020-2025. This trend would appear poised to continue given two ongoing phenomena, the first being the planned phase out of bank-issued AT1 securities. We expect a shrinking hybrid market may lead to the deployment of capital into other income-generating markets, such as private credit. Compounding this shift is the newly introduced tax on unrealised gains for superannuation balances above a certain threshold. In our view, this change is likely to drive a rotation away from long-dated, illiquid exposures (such as venture capital, private equity, and real estate) toward more liquid, income-generating alternatives - most notably, private credit.

2. Tentative Signs of Recovery in Real Estate

The second theme has been a modest recovery across most real estate markets. In broad strokes, this is reflected by the steady increase in the Daily Back Series for each of the five major Australian metropolises represented in CoreLogic RP Data (with their 5 capital city aggregate up 1.4% year to date through the end of May 2025) (www.corelogic.com.au/our-data/corelogic-indices#daily-indices). During the quarter, HCP’s borrowers completed the sale of seven assets (one of which is currently under unconditional contract) forming part of our loan collateral. On average, these assets sold at a 2.78% premium to HCP’s internal valuation – one that tends to err on the side of conservatism – with only one asset trading below valuation (-6.67%). Encouragingly, agents in various markets are reporting higher levels of enquiry and improved sentiment from buyers.

Despite these positive signs, we remain cautious about sweeping conclusions based on recent headlines touting the extent of the market rebound. Most housing price indices rely on median sale prices over a defined period. While informative, this method does not account for all quantitative indicators such as clearance rates, auction withdrawals and the number of bidders per property, or qualitative factors such as differences between assets that are selling versus those languishing. As such, we continue to focus on transactions where market depth and liquidity are more measurable and transparent.

HCP Portfolio Snapshot – H1 2025

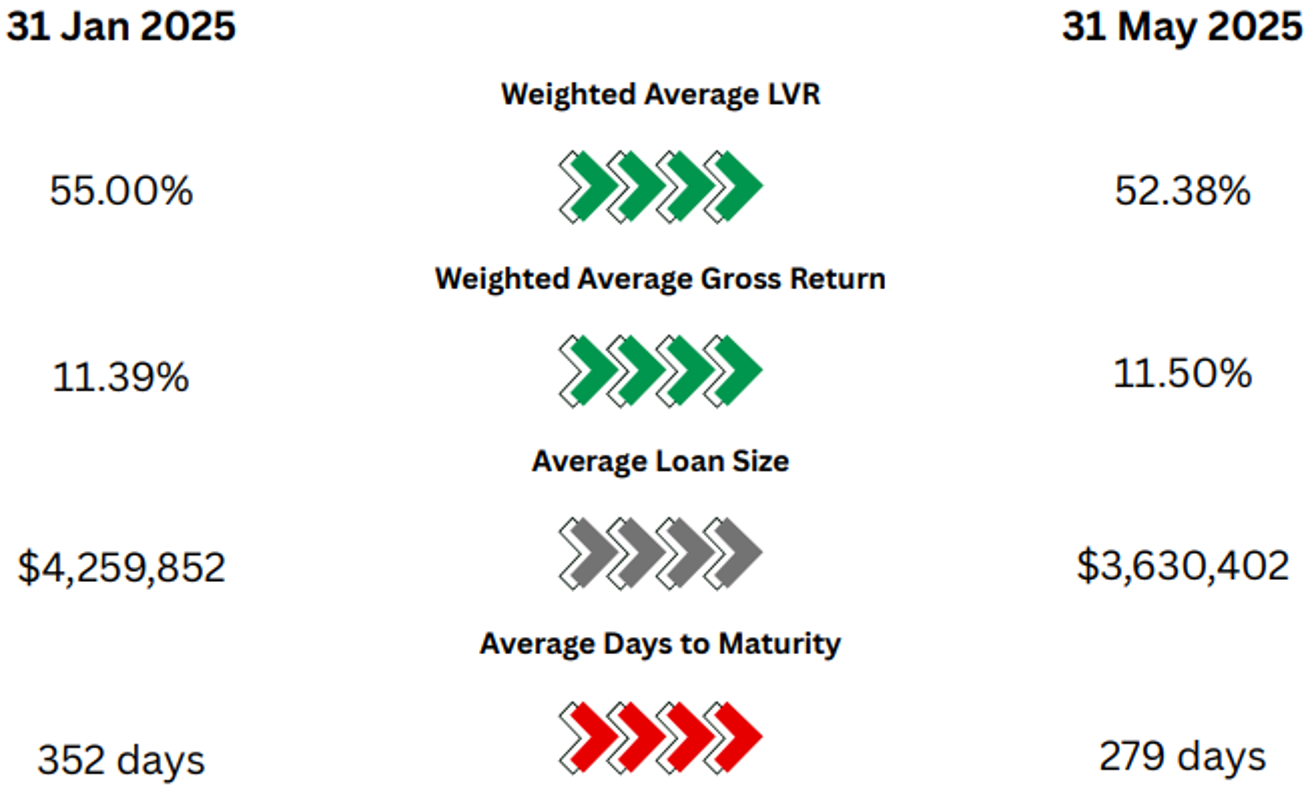

Given this evolving landscape, we thought it timely to share key metrics from our loan portfolio over the first five months of 2025:

Total Loans Funded: $41,358,893

Total Loans Repaid: $33,087,500

Comparative Portfolio Statistics: 31 Dec 2024 to 31 May 2025

Note: Portfolio Statistics are based on all Project Loans held in the Harbour Credit Partners Master Trust

Gross Return is prior to any management fees charged to investors

Pleasingly, we have seen the weighted average interest rate of our portfolio inch up, even as the weighted average LVR has fallen modestly. The average size of our loans has dropped to just over $3.6 million as some larger loans have rolled off, and the average days to maturity in the portfolio in the portfolio has declined to 279 days owing to two main factors:

i) A slower origination rate; and

ii) A deliberate effort to shorten the duration of HCP’s book so as to preserve flexibility in an uncertain, low-premium environment.

Generally lower transaction volume, along with increased competition in the bridge lending space, can account for the risk/return profile of our current pipeline of prospective deals:

Average Gross Return: 10.39% *

Weighted Average LVR: 42.24%

* Gross Return is prior to any management fees charged to investors.

In the context of the long-term objectives of our Harbour Credit Partners Diversified Mortgage Fund, where we are targeting a net return of cash + 400 bps per annum (currently 7.85%) at a maximum weighted average LVR of 60%, we remain heartened that these metrics remain attractive.

Loan Repayment Breakdown

We have had 19 loans in the portfolio repay so far, with the exit strategies deployed summarised as follows:

Notably, these loans were repaid on average 141 days before maturity.

Defaults

Within the entirety of the HCP portfolio, there are currently two loans that are in default (out of 42 active positions). Both situations involve borrower counterclaims and are being actively managed. We remain confident of full recovery of principal and interest in both cases, particularly given the modest LVR at which each loan was originally extended.

Looking Ahead

As we approach the second half of 2025, and a new financial year in Australia, the investment team at Harbour Credit Partners remains focused on what we believe to be the hallmarks of the firm: capital preservation, the pursuit of the best risk-adjusted return being presented by the current opportunity set, and discipline in underwriting. In an environment characterised by features of which we have spoken (or written) regularly – compressed spreads, reduced market clarity, and increased competition – we think that these principles are as essential as they have ever been.

Firm Update

During the month, Harbour Credit Partners welcome Devyn Grantham to our team as a Business Development Manager – Originations. In addition to engaging directly with borrowers, HCP relies upon a network of pre-approved originators to help us source loan opportunities. In turn, these relationships help our investment team obtain access to a broader array of transactions to which we can consider deploying capital in the pursuit of building a diversified portfolio offering an optimal risk-adjusted return for the benefit of our capital partner and external wholesale investors who have entrusted us with a portion of their capital.

Devyn comes to the firm with eight years of experience and brings with him direct white-label financial product sales experience, bridging finance domain knowledge, a consultative enterprise sales skill set, and a track record of onboarding and enabling distribution partners. We look forward to the firm and our clients reaping the benefit of Devyn’s efforts to broaden our originator relationships.

About Harbour Credit Partners

Harbour Credit Partners is a Sydney-based private real estate loans manager and a joint venture with the IJD Group, our capital partner. Wholesale investors are eligible to coinvest in specific loans settled by the HCP investment team in the Harbour Credit Partners Master Trust (funded via the IJD Group’s balance sheet), or to invest in a diversified pool of underlying loans via the Harbour Credit Partners Diversified Mortgage Fund.

For a complete list of HCP’s current active loan portfolio (including those opportunities where the capacity available to external investors has been exhausted), please access the following link:

https://harbourcreditpartners.portal.agorareal.com/#/public/offerings

Please contact Jonathan Goll, Head of Investor Solutions, with any questions or comments that you might have, or should you need assistance with setting up an account and applying for investment with the firm.

Jonathan Goll

Head of Investor Solutions

M: +61 438 082 247

E: jgoll@harbourcreditpartners.com

Level 5, 131 Macquarie Street, Sydney NSW 2000

harbourcreditpartners.com

Any information or advice contained in this newsletter is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Before acting on any information or advice in this newsletter, you should consider the appropriateness of it (and any relevant product) having regard to your circumstances and, if a current offer document is available, read the offer document before acquiring products named on this website. You should also seek independent financial advice prior to acquiring a financial product.

All financial products involve risks. Past performance of any product described in this newsletter is not a reliable indication of future performance.

Harbour Credit Partners Pty Ltd is the Investment Manager of the Harbour Credit Partners Master Trust. It holds a Corporate Authorised Representative authorisation CAR No.001308393 from Quay Wholesale Fund Services Pty Ltd (Quay) (AFSL No. 528 526). Harbour Credit Partners Pty Ltd also holds a Corporate Authorised Representative authorisation from Quay allowing it to provide General Product Advice.